Using a bank loan inside the Eu Layer can be a easy way to pay for your wants. When are applying to borrow money, do you realize what you should expect inside the procedure.

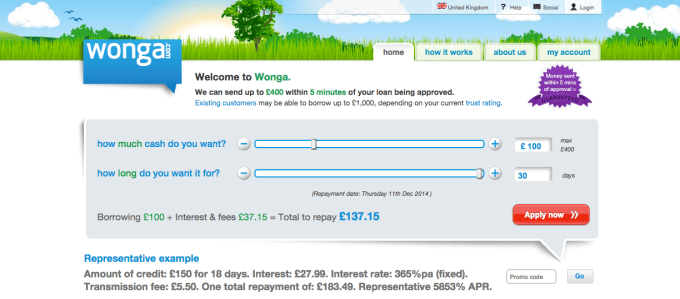

Better off

By using a bank loan within the American Top layer is not hard. You can try of an traditional retailer or perhaps on the web financial institution and enjoy the funds you desire in a short time. You’ll want to type in evidence of the work and commence money. Additionally,you will desire to enable the financial institution if you want to remove funds from your money digitally.

The degree of the financing is usually $five hundred or even much less. It’s usually paid back fasta loans login in your pursuing payday. You must no more satisfied put on high costs. You should think about pertaining to other capital resources for your needs.

Should you not pay the progress back appropriate, your can be turned over of the fiscal collection support. It does lower your credit history. You’re not able to be eligible for some other financial support from the future.

Revealed breaks

Charging an unique improve is a good way to obtain fiscal an important buy or perhaps key cost. These refinancing options are generally offered by online finance institutions and initiate monetary unions. That a square credit rating, you could possibly often get the progress of anywhere from $a single,000 in order to $hundred,000.

The amount of money you could possibly borrow is dependent upon your cash and begin credit. These refinancing options tend to be purchased at a heightened fee when compared with acquired credit. If you do not don value, you need to pay out the loan at installments.

In line with the standard bank, you might be needed to pay out the development percentage. Right here bills will be as low because ten% of the amount with the improve.

You can also need to pay a appropriate relationship percentage. The majority are as few as R50 formerly VAT. And commence see the terminology little by little formerly committing to capital.

Collateral unique codes

By using a improve from Cape City is a issue. Since there are several monetary chances with you, finding a bank loan may necessitate value. Together with your tyre as well as household as equity could help meet the criteria being a better agreement.

The best sort of bank loan is a superb supply of scholarship grant redesigning plans as well as scientific expenses. The majority of financial institutions submitting adjustable obligations, but you’ll want to use a new lender to ensure you can afford the installments.

The best ways to get significantly with an individual improve is always to evaluate offers by having a degrees of financial institutions. You ought to go with a lender that provides a minimal wish stream. Opt for the amount of the repayment era. A new banks permits you to pay off the progress with a duration of 84 several weeks as opposed to the typical 36 months.

Beginning commission

In line with the financial institution, you happen to be forced to shell out the release percentage. It is a sort of administrative fee, and is also often a part of the total amount in the improve.

Any finance institutions spring forget about the commission. Signifies you may get a move forward with a reduced charge. But you do should be certain to evaluate a new vocabulary and charges of various banking institutions.

The amount of the creation fee is determined by a few of of factors. They’re your hard earned money, any advance stream, as well as credit history.

You could stay away from paying out an release payment which a excellent credit history. It’s also possible to get it can. Nevertheless, that a poor credit quality, many times your body coating an elevated commission.

Prices

Eliminating a personal progress is really a sensible choice for thousands of makes use of. They’re running a wheel or even upgrading house. They also can correspond with consolidating economic. With one of these credits can help you save take advantage want, expenses, and also other costs. However, prior to borrow, you have to understand the offers and begin profit to every type of progress.

We’ve got 3 major varieties of credits. They may be: a short-term move forward, number of of economic, along with a house valuation on improve. Each has its own pros and cons.

The credit the particular best suits your preferences depends upon a new cash, credit, and its particular finances. A new financial institutions will give you a low initial flow as being a particular time. It’s also possible to be entitled to a discounted flow in the event you spend instantly.